We’ve all heard about the many pump-and-dumps taking place constantly but, like many others, I’ve tried to stay above the fray and focus my attention on the sustainable, long-term currencies and trends. But, alas, my curiosity got the best of me and I began to follow some pump-and-dump Telegram channels.

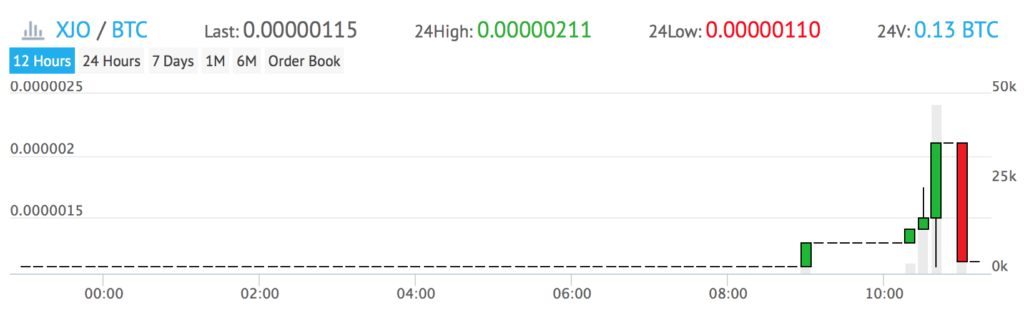

And so, I witnessed firsthand an XYO/BTC trading pair pump-and-dump that occurred this morning on the Yobit exchange, as seen below:

Here we notice a sudden increase in trading price right after a Telegram channel called “Crypto God’s” [sic] advised it’s members to buy XJO. This channel only has just over a thousand members but the results were fast and substantial. Of course, we’ve all heard of much larger increases in value (this particular pump peaked at a 91% increase) but it was still entertaining to see a scheme like this unfold.

A few hours later we see XJO holding its gains with a slight increase beyond the prior price and a larger trading volume. Like any pump and eventual dump, there are likely several parties within this movement with varying knowledge, subject to multiple directives as to how long to hold, and who hold a range of positions that vary in their ability to affect price with their total value. These factors determine who the big winners, winners, and losers are. Since pumpers typically look for new, low volume, and often worthless coins that wouldn’t show substantial gains on their own, there’s always the risk that you’ll get stuck with a worthless coin that no one will buy in a timely manner and you won’t be able to dump in time despite jumping in on the pump.

An exercise like this is much harder to pull off (and much less tolerated) in the traditional markets although the OTC or “pink sheets” are sometimes manipulated though email blasts and other tactics. However, due to cryptocurrency market conditions and the fact that regulators are generally several steps behind currencies, exchanges, and (often anonymous) market actors, these types of schemes occur on a regular basis. And, like any scheme, there are winners and losers and the difference is information. I would call this free market antics but, as any economist will tell you, markets do not work efficiently without equal information. Until the collective global regulatory body (AKA “The Man”) catches up with the libertarian/anarchist/capitalist experiment that will become the future of commerce, caveat emptor!

Follow us on Telegram